Resolution Timeshare Cancellation

Resolution Timeshare Cancellation Review

Resolution Timeshare Cancellation (RTC) has long enjoyed a good reputation among timeshare exit companies. It’s often praised for solid ratings, user feedback, and notably, for being one of the few that actually uses an escrow model, something rare in the timeshare exit world.

Websites like BestCompany are largely responsible for shaping RTC’s public image as a reputable player. Yet, even they include a disclaimer at the top of their site: “We may receive referral compensation from some of the companies on our site. This compensation does not impact their reviews or rankings.” Sure, that’s what they say, but it’s hard not to wonder how unbiased those reviews truly are.

According to BestCompany’s overview, RTC’s supposed highlights include:

- No Upfront Fees Required

- Flat-Rate Service Fees

- Transparency

- Industry Experience

- Positive Online Reviews

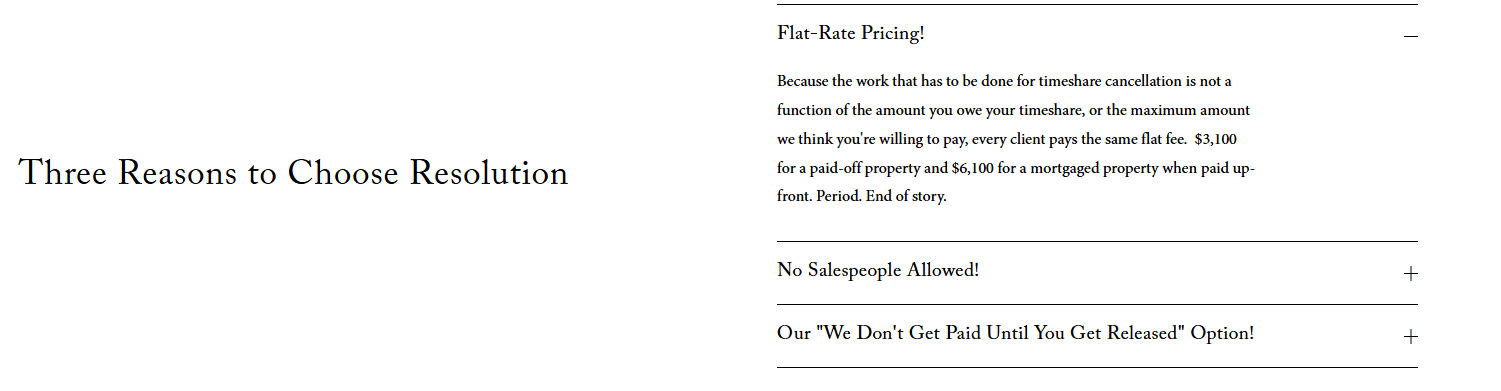

RTC’s own website also echoes this—claiming there’s no upfront cost for consultations or to start the cancellation process. Technically, this is true… to a point. They clarify that “we also give you the option to pay upfront at half the price of escrow.” So, while it’s optional, paying upfront is still part of the conversation.

They’re also very open about their flat-rate pricing, which is at least commendable for a company in this space.

- $3,100 for paid-off properties

- $6,100 for mortgaged ones

It’s listed right on their homepage, something that at least gives an impression of transparency. However, a quick glance at their BestCompany listing shows an entirely different set of numbers: $2,700 (no mortgage) and $3,700 (with mortgage). Outdated info? Possibly. Misleading? Potentially. Either way, it raises questions.

The inconsistencies don’t end there. BestCompany’s page mentions RTC can’t work with “Club Land’or” timeshares, yet on RTC’s actual site, that resort isn’t listed among their exclusions. There, they only name Capital Vacations and a few others. Another case of outdated data? Seems likely, but it’s worth noting.

Still, compared to other exit companies, RTC’s level of transparency is refreshing. Most firms in this industry prefer to play coy with pricing — as if they’re doing you a favor by not disclosing what their “services” actually cost. So, points to RTC for not hiding behind smoke and mirrors.

Interestingly, RTC also references other exit companies it considers “reputable,” such as Centerstone, Seaside, Lonestar, and Newton Group. That alone gives them a touch of humility — they’re not trying to sell themselves as the one-and-only legitimate option out there.

Their FAQ section is another strong point: well-written, detailed, and surprisingly honest. They admit they can’t assist with timeshares from Capital Vacations, Massanutten, or Disney. Even more surprisingly, they acknowledge that some owners can cancel directly through their own resort’s deed-back or exit program — no third-party help needed. It’s rare honesty for this kind of business.

So far, so good, right? Well… here’s where things start to fall apart.

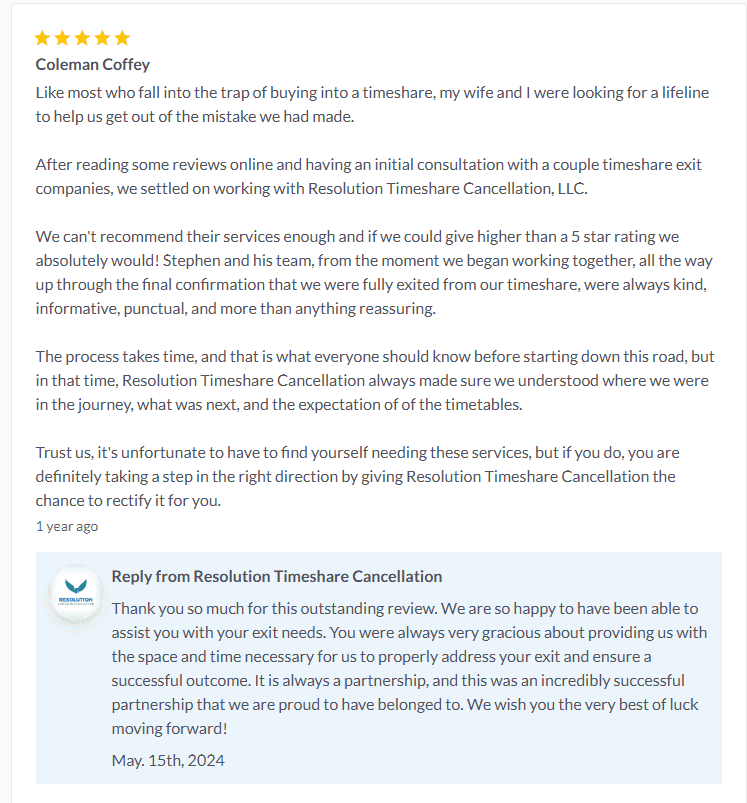

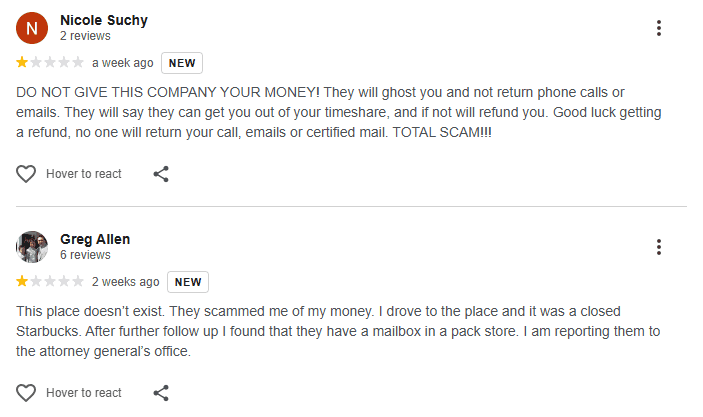

When we dug into their reviews, things got messy. RTC has listings on Google, BestCompany, and the BBB. On BestCompany, they still get the occasional review — the newest one in 2025 (as of October), with their last official response dating back to early 2024. Only two reviews in 2024 (both the exact same), most others from 2023 and earlier. In short: things feel a bit stale.

At first glance, their feedback looks fairly balanced — a mix of positive and negative experiences, suggesting they’re not filtering out criticism. Their BBB page shows no official complaints, while their Google Reviews hover around a 3.7-star average. But when you look closer, the timeline tells a different story.

As of 2025, a worrying trend has emerged: a wave of new complaints describing RTC as unresponsive. Multiple recent Google reviews mention the same issues — no callbacks, no emails, constant delays — all ending with no results. These reviews, spread across different users and months, show a consistent pattern that’s hard to ignore.

All the carefully crafted trust that RTC built over the years seems to be unraveling. Their old credibility is crumbling under mounting recent complaints and radio silence from their team. Once a company we might’ve rated at 3.5 or even 4 stars, it’s now falling to a 2-star warning in our eyes.

And unfortunately, it doesn’t stop there.

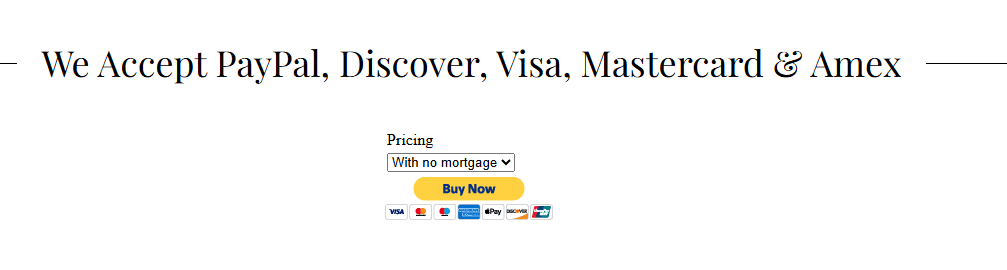

There’s another concern worth highlighting — what appears to be a copycat website. RTC’s legitimate domain is resolutiontsc.com. However, there’s a suspiciously similar clone: resolutiontsc1.com — note the “1.” This fake site features a functional PayPal link for “pricing,” where users can freely send money… but to whom? And for what? It’s sketchy, to say the least.

Hopefully, it’s merely a scammer trying to exploit RTC’s name—but the potential for user confusion is alarming. If you do reach out to Resolution Timeshare Cancellation, make absolutely sure you’re using the correct domain—the one without the “1.”

At the end of the day, RTC used to be one of the more trustworthy timeshare exit options — transparent pricing, escrow availability, and fair communication. But the recent decline in customer service, outdated public info, and emerging clone-site risks have turned that trust into caution.

Our verdict: once promising, now questionable. 2 out of 5 stars. Proceed with caution—and double-check that URL before you even think about paying a dime.