Fidelity Resource Management

Fidelity Resource Management (FRM) presents itself as a timeshare exit company with a moderate amount of history behind it (Not to be confused with Fidelity's Wealth Management service, a completely separate company focused on stock and investment services.). Based on publicly visible activity—particularly their Facebook presence—the company appears to have been active since around 2017. We noticed a clear surge in engagement and marketing during 2019–2020, followed by a notable slowdown throughout 2021 and 2022. Activity resurfaces sporadically in 2024, with more consistent advertising efforts returning again in 2025.

On their website, FRM offers informational blog posts discussing timeshares and warning consumers about common pitfalls in the industry. While the content itself is not inherently misleading, much of it dates back to 2017, which raises questions about how current or updated their guidance actually is. Educational content can be a positive sign, but only when it evolves alongside laws, practices, and consumer protections.

One element that immediately gave us pause is their so‑called “free” ebook. While it carries no upfront monetary cost, users are required to provide personal information such as their name, phone number, and email address to access it. In the timeshare exit space, this kind of lead‑capture tactic is extremely common, but it is still something we believe users should approach with caution.

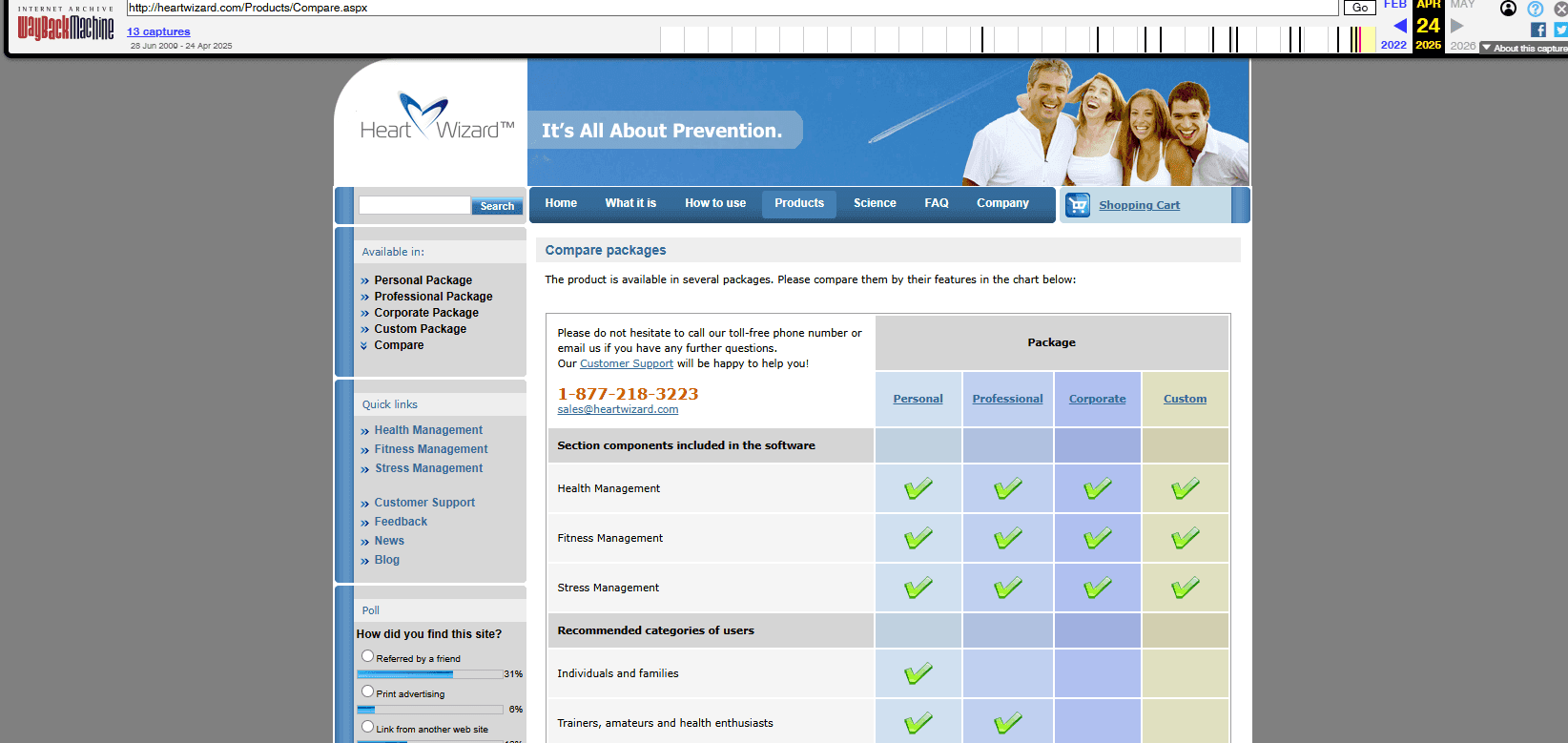

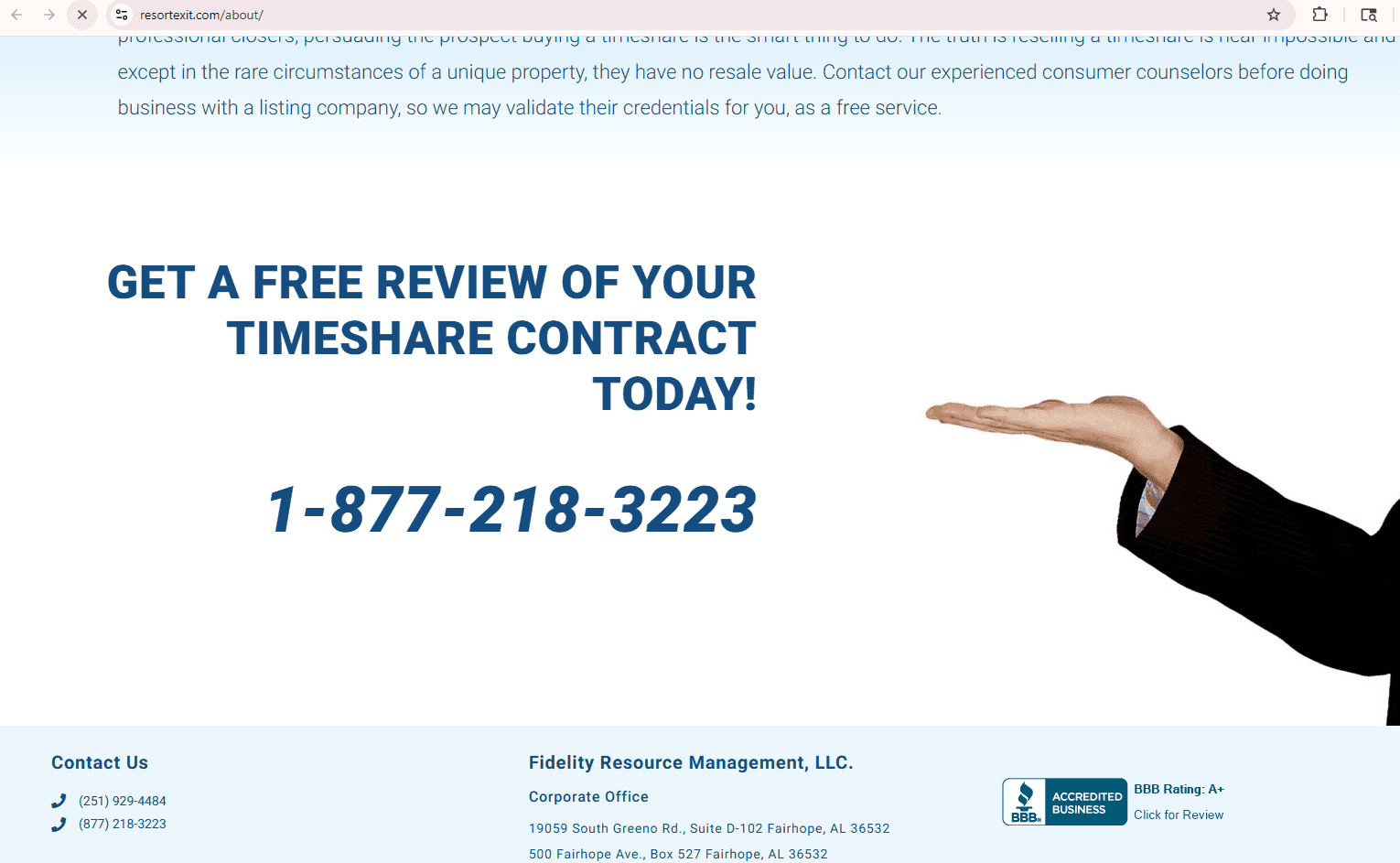

Another oddity worth highlighting involves one of the phone numbers associated with Fidelity Resource Management: 1‑877‑218‑3223. This number was previously linked to a health‑related company known as Heart Wizard and, rather strangely, appeared to remain functional for that purpose until at least August 2025. On FRM’s website, this number intermittently appears on their About page, often flashing briefly when the page reloads or when users tab into it—almost as if it is intentionally being kept out of direct view. While not definitive proof of wrongdoing, inconsistencies like this do little to inspire confidence.

So, what do customers actually say about Fidelity Resource Management?

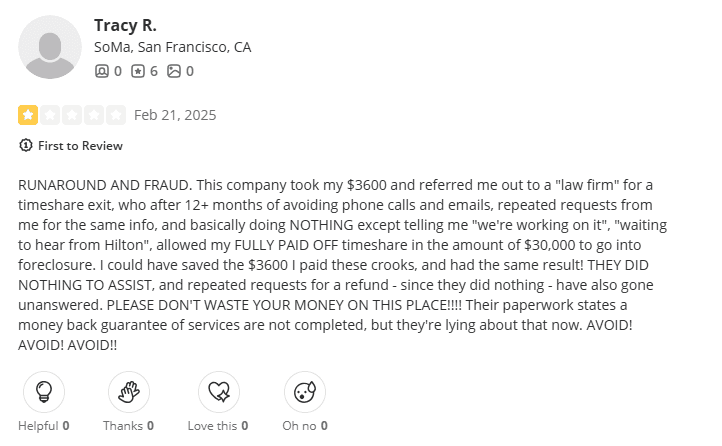

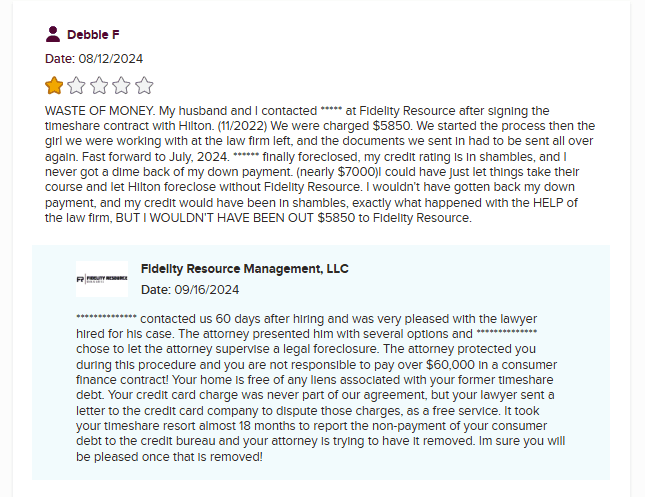

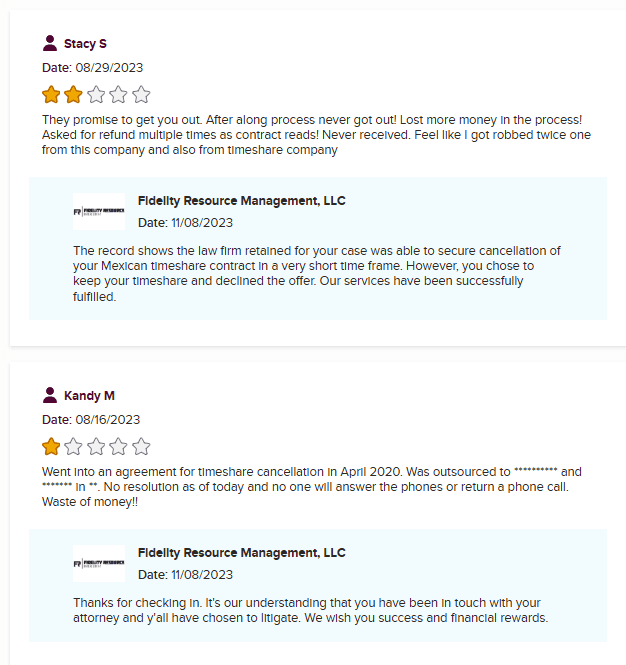

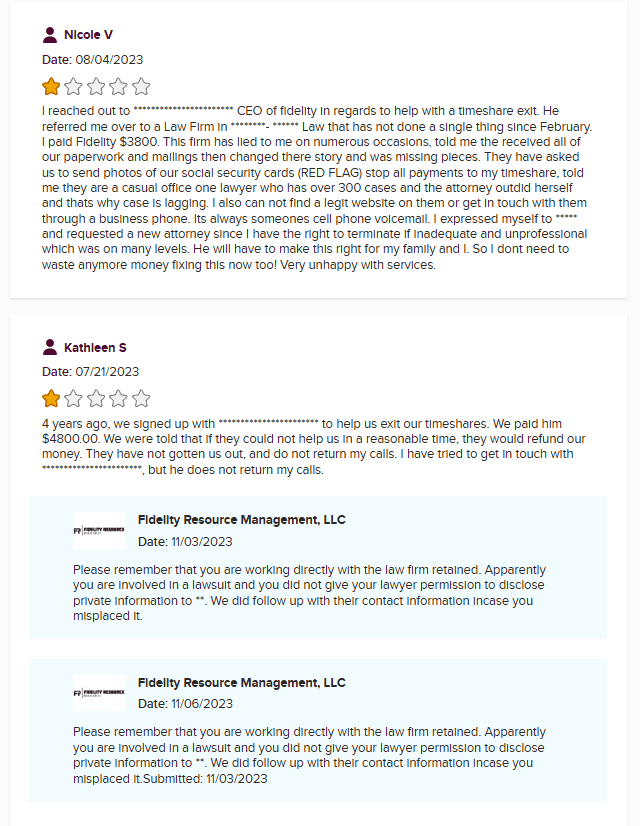

Fortunately, FRM does have reviews spanning multiple years, even if they are relatively sparse. Reviews from 2025 trend more positively, with some users reporting satisfactory outcomes. However, looking back to 2023, we observed a noticeable cluster of complaints. Many of these negative reviews allege that FRM allowed timeshares to fall into foreclosure as a method of “exit,” rather than securing a clean and properly documented cancellation. Several former clients also reported negative impacts to their credit scores, which they attribute to FRM’s failure to resolve matters responsibly or transparently.

This ultimately leaves us in a very mixed, nearly 50‑50 scenario. Some consumers appear relieved and satisfied, while others report financial stress, damaged credit, and unmet expectations. As with many companies operating in the timeshare exit industry, trustworthiness is difficult to assess without personal risk.

Our takeaway is straightforward: Fidelity Resource Management is not an outright scam based on available information, but there are enough inconsistencies, complaints, and unanswered questions to warrant caution. If you choose to explore their services, we strongly recommend doing so with skepticism, asking direct questions, and avoiding any strategy that relies on foreclosure as an “exit.” When it comes to timeshare exit companies, a proceed with caution mindset is not optional—it’s essential.